3569

Views

1674

Downloads |

An international integration history of the Zagreb Stock Exchange

Luka Šikić*

Article | Year: 2017 | Pages: 227 - 257 | Volume: 41 | Issue: 2 Received: December 21, 2016 | Accepted: March 14, 2017 | Published online: June 15, 2017

|

FULL ARTICLE

FIGURES & DATA

REFERENCES

CROSSMARK POLICY

METRICS

LICENCING

PDF

|

|

ZSE

|

S&P500

|

FTSE100

|

STOXX600

|

ATX

|

DAX

|

BUX

|

PX

|

WIG20

|

|

Mean

|

0.000

|

0.000

|

0.000

|

0.000

|

0.000

|

0.000

|

0.000

|

0.000

|

0.000

|

|

Median

|

0.000

|

0.000

|

0.000

|

0.000

|

0.000

|

0.000

|

0.000

|

0.000

|

0.000

|

|

Max.

|

0.175

|

0.109

|

0.103

|

0.094

|

0.120

|

0.107

|

0.136

|

0.123

|

0.137

|

|

Min.

|

-0.194

|

-0.094

|

-0.083

|

-0.081

|

-0.133

|

-0.127

|

-0.214

|

-0.161

|

-0.207

|

|

Std. dev.

|

0.015

|

0.012

|

0.010

|

0.013

|

0.014

|

0.015

|

0.017

|

0.014

|

0.017

|

|

Skewness

|

-0.054

|

-0.194

|

-0.255

|

-0.285

|

-0.546

|

-0.241

|

-0.778

|

-0.476

|

-0.506

|

|

Kurtosis

|

24.923

|

10.606

|

9.869

|

8.021

|

11.095

|

7.622

|

16.693

|

14.274

|

11.836

|

|

Jarque- Berra

(p-value)

|

(0.000)

|

(0.000)

|

(0.000)

|

(0.000)

|

(0.000)

|

(0.000)

|

(0.000)

|

(0.000)

|

(0.000)

|

|

No. obs.

|

4,650

|

4,650

|

4,650

|

4,632

|

4,632

|

4,632

|

4,632

|

4,648

|

4,632

|

|

ADF

|

-18.222

|

-16.60064

|

-20.567

|

-20.954

|

-22.719

|

-20.399

|

-21.693

|

22.471

|

-23.877

|

|

Probability

|

(0.000)

|

(0.000)

|

(0.000)

|

(0.000)

|

(0.000)

|

(0.000)

|

(0.000)

|

(0.000)

|

(0.000)

|

|

ARCH(10)

|

135.490

|

167.816

|

178.484

|

100.647

|

130.147

|

77.540

|

83.972

|

63.246

|

55.157

|

|

Probability

|

(0.000)

|

(0.000)

|

(0.000)

|

(0.000)

|

(0.000)

|

(0.000)

|

(0.000)

|

(0.000)

|

(0.000)

|

|

Year

|

S&P500

|

FTSE100

|

DJSTOXX

|

ATX

|

DAX

|

BUX

|

PX

|

WIG20

|

|

1997

|

0.340

|

0.616

|

0.432

|

0.716

|

0.749

|

0.689

|

0.811

|

0.823

|

|

1998

|

0.211

|

0.378

|

0.350

|

0.494

|

0.459

|

0.490

|

0.577

|

0.494

|

|

1999

|

0.051

|

-0.001

|

0.107

|

0.222

|

0.140

|

0.238

|

0.313

|

0.307

|

|

2000

|

0.041

|

0.014

|

0.119

|

0.135

|

0.161

|

0.059

|

0.207

|

0.261

|

|

2001

|

0.059

|

0.047

|

0.145

|

0.278

|

0.117

|

0.222

|

0.202

|

0.181

|

|

2002

|

-0.053

|

-0.079

|

-0.011

|

0.068

|

0.093

|

0.036

|

0.095

|

0.094

|

|

2003

|

0.184

|

0.026

|

0.212

|

0.213

|

0.086

|

0.202

|

0.133

|

0.139

|

|

2004

|

0.045

|

-0.016

|

0.110

|

0.172

|

0.163

|

0.158

|

0.066

|

0.075

|

|

2005

|

0.021

|

0.008

|

0.042

|

0.074

|

0.101

|

0.030

|

0.139

|

0.109

|

|

2006

|

-0.029

|

0.015

|

0.037

|

0.102

|

0.131

|

0.092

|

0.216

|

0.100

|

|

2007

|

0.095

|

0.058

|

0.226

|

0.285

|

0.306

|

0.285

|

0.253

|

0.277

|

|

2008

|

0.474

|

-0.129

|

0.668

|

0.673

|

0.658

|

0.672

|

0.545

|

0.563

|

|

2009

|

0.360

|

0.009

|

0.547

|

0.605

|

0.574

|

0.557

|

0.375

|

0.505

|

|

2010

|

0.230

|

-0.045

|

0.339

|

0.353

|

0.363

|

0.313

|

0.312

|

0.355

|

|

2011

|

0.302

|

-0.095

|

0.385

|

0.463

|

0.498

|

0.448

|

0.364

|

0.417

|

|

2012

|

0.272

|

-0.046

|

0.353

|

0.346

|

0.392

|

0.366

|

0.240

|

0.281

|

|

2013

|

0.059

|

0.031

|

0.089

|

0.130

|

0.077

|

0.132

|

0.051

|

0.044

|

|

2014

|

0.193

|

0.070

|

0.217

|

0.225

|

0.136

|

0.184

|

0.086

|

0.184

|

|

2015

|

0.220

|

-0.073

|

0.237

|

0.251

|

0.232

|

0.230

|

0.174

|

0.226

|

|

2016

|

0.290

|

-0.016

|

0.361

|

0.398

|

0.350

|

0.386

|

0.345

|

0.211

|

|

Average

|

0.168

|

0.039

|

0.248

|

0.310

|

0.289

|

0.289

|

0.275

|

0.282

|

|

Index

|

Model

|

ω

|

α

|

β

|

γ

|

Logl

|

AIC

|

|

CROBEX

|

sGARCH

|

0.012

(0.000)

|

0.096

(0.000)

|

0.902

(0.000)

|

–

|

-7,095.87

|

3.053

|

|

S&P500

|

sGARCH

|

0.049

0.000)

|

0.089

(0.000)

|

0.897

(0.000)

|

–

|

-6,730.90

|

2.896

|

|

FTSE100

|

sGARCH

|

0.014

0.000)

|

0.098

(0.000)

|

0.891

(0.000)

|

–

|

-6,220.28

|

2.677

|

|

STOXX600

|

sGARCH

|

0.024

(0.000)

|

0.009

(0.173)

|

0.899

(0.000)

|

–

|

-6,912.23

|

2.986

|

|

ATX

|

eGARCH

|

0.013

0.000)

|

0.090

(0.000)

|

0.976

(0.000)

|

0.0448

(0.004)

|

-7,427.90

|

3.209

|

|

DAX

|

gjrGARCH

|

0.035

(0.000)

|

0.018

(0.003)

|

0.898

(0.000)

|

0.027

(0.110)

|

-7,911.81

|

3.418

|

|

BUX

|

eGARCH

|

0.039

(0.000)

|

0.017

(0.003)

|

0.878

(0.000)

|

0.029

(0.000)

|

-8,111.81

|

3.497

|

|

PX

|

gjrGARCH

|

0.041

(0.000)

|

0.017

(0.003)

|

0.925

(0.000)

|

0.036

(0.000)

|

-7,727.90

|

3.312

|

|

WIG20

|

gjrGARCH

|

0.044

(0.000)

|

0.016

(0.005)

|

0.944

(0.000)

|

0.040

(0.000)

|

-8,561.01

|

3.698

|

|

Index pairs

|

Model

|

α

|

β

|

γ

|

Logl

|

AIC

|

|

CROBEX –

S&P500

|

DCC

|

0.007

(0.001)

|

0.989

(0.000)

|

–

|

-13,759.50

|

5.922

|

|

CROBEX –

FTSE100

|

DCC

|

0.016

(0.003)

|

0.978

(0.000)

|

–

|

-13,157.02

|

5.663

|

|

CROBEX –

STOXX600

|

ADCC

|

0.019

(0.001)

|

0.968

(0.000)

|

0.005

(0.338)

|

-13,846.02

|

5.973

|

|

CROBEX –

ATX

|

ADCC

|

0.022

(0.000)

|

0.960

(0.000)

|

0.007

(0.500)

|

-14,364.07

|

6.196

|

|

CROBEX –

DAX

|

ADCC

|

0.019

(0.001)

|

0.962

(0.000)

|

0.008

(0.375)

|

-14,774.70

|

6.374

|

|

CROBEX – BUX

|

DCC

|

0.018

(0.001)

|

0.952

(0.000)

|

–

|

-14,763.90

|

6.467

|

|

CROBEX – PX

|

DCC

|

0.017

(0.001)

|

0.976

(0.000

|

–

|

14,257.03

|

6.033

|

|

CROBEX – WIG20

|

DCC

|

0.0055

(0.068)

|

0.986

(0.000)

|

–

|

-15,452.06

|

6.666

|

|

Year

|

S&P500

|

FTSE100

|

DJSTOXX

|

ATX

|

DAX

|

BUX

|

PX

|

WIG20

|

|

1997

|

0.169

|

0.239

|

0.429

|

0.465

|

0.437

|

0.480

|

0.194

|

0.542

|

|

1998

|

0.226

|

0.329

|

0.405

|

0.407

|

0.414

|

0.483

|

0.286

|

0.402

|

|

1999

|

0.138

|

0.189

|

0.270

|

0.248

|

0.259

|

0.343

|

0.287

|

0.296

|

|

2000

|

0.053

|

0.125

|

0.201

|

0.213

|

0.141

|

0.238

|

0.212

|

0.307

|

|

2001

|

0.085

|

0.154

|

0.263

|

0.177

|

0.237

|

0.231

|

0.183

|

0.268

|

|

2002

|

0.028

|

0.058

|

0.154

|

0.142

|

0.131

|

0.195

|

0.113

|

0.245

|

|

2003

|

0.160

|

0.222

|

0.254

|

0.158

|

0.242

|

0.215

|

0.188

|

0.240

|

|

2004

|

0.136

|

0.171

|

0.216

|

0.213

|

0.198

|

0.189

|

0.186

|

0.215

|

|

2005

|

0.070

|

0.091

|

0.148

|

0.166

|

0.133

|

0.198

|

0.195

|

0.233

|

|

2006

|

-0.010

|

0.049

|

0.151

|

0.168

|

0.147

|

0.253

|

0.215

|

0.225

|

|

2007

|

0.074

|

0.180

|

0.244

|

0.249

|

0.249

|

0.233

|

0.212

|

0.297

|

|

2008

|

0.187

|

0.409

|

0.475

|

0.446

|

0.462

|

0.339

|

0.394

|

0.415

|

|

2009

|

0.307

|

0.474

|

0.503

|

0.469

|

0.457

|

0.343

|

0.420

|

0.385

|

|

2010

|

0.253

|

0.351

|

0.368

|

0.363

|

0.334

|

0.306

|

0.366

|

0.350

|

|

2011

|

0.210

|

0.258

|

0.303

|

0.294

|

0.288

|

0.250

|

0.262

|

0.299

|

|

2012

|

0.273

|

0.356

|

0.344

|

0.348

|

0.342

|

0.277

|

0.306

|

0.312

|

|

2013

|

0.114

|

0.140

|

0.215

|

0.176

|

0.205

|

0.199

|

0.184

|

0.231

|

|

2014

|

0.154

|

0.205

|

0.238

|

0.183

|

0.225

|

0.199

|

0.164

|

0.277

|

|

2015

|

0.190

|

0.205

|

0.225

|

0.222

|

0.221

|

0.238

|

0.230

|

0.297

|

|

2016

|

0.222

|

0.299

|

0.338

|

0.306

|

0.332

|

0.292

|

0.307

|

0.283

|

|

Average

|

0.152

|

0.225

|

0.287

|

0.271

|

0.273

|

0.275

|

0.245

|

0.306

|

|

|

S&P500

|

FTSE100

|

DJSTOXX

|

ATX

|

DAX

|

BUX

|

PX

|

WIG20

|

|

Pre-crisis

|

0.241

|

0.329

|

0.454

|

0. 747

|

0.462

|

0.493

|

0.213

|

0.542

|

|

Post-crisis

|

0.113

|

0.198

|

0.297

|

0.257

|

0.302

|

0.371

|

0.309

|

0.313

|

|

|

S&P500

|

FTSE100

|

DJSTOXX

|

ATX

|

DAX

|

BUX

|

PX

|

WIG20

|

|

Pre-crisis

|

0.057

|

0.083

|

0.141

|

0.112

|

0.103

|

0.319

|

0.269

|

0.253

|

|

Crisis

|

0.030

|

0.078

|

0.163

|

0.107

|

0.118

|

0.222

|

0.168

|

0.191

|

|

Post-crisis

|

0.127

|

0.165

|

0.182

|

0.122

|

0.175

|

0.214

|

0.188

|

0.104

|

|

|

S&P500

|

FTSE100

|

DJSTOXX

|

ATX

|

DAX

|

BUX

|

PX

|

WIG20

|

|

Pre-crisis

|

0.002

|

0.039

|

0.121

|

0.136

|

0.100

|

0.219

|

0.197

|

0.112

|

|

Crisis

|

0.263

|

0.454

|

0.547

|

0.526

|

0.531

|

0.324

|

0.361

|

0.487

|

|

Post-crisis

|

0.279

|

0.376

|

0.403

|

0.413

|

0.381

|

0.296

|

0.346

|

0.370

|

|

|

S&P500

|

FTSE100

|

DJSTOXX

|

ATX

|

DAX

|

BUX

|

PX

|

WIG20

|

|

Announcement

|

0.370

|

0.305

|

0.333

|

0.364

|

0.330

|

0.262

|

0.286

|

0.275

|

|

Post-accession

|

0.169

|

0.184

|

0.202

|

0.156

|

0.219

|

0.213

|

0.193

|

0.208

|

|

Index

|

Model

|

ω

|

α

|

γ

|

β

|

Logl

|

AIC

|

|

CROBEX

|

sGARCH

|

1.587

(0.002)

|

0.384

(0.005)

|

|

0.558

(0.000)

|

-501.785

|

5.007

|

|

S&P500

|

sGARCH

|

0.067

(0.206)

|

0.145

(0.018)

|

|

0.830

(0.000)

|

-319.208

|

3.201

|

|

FTSE100

|

sGARCH

|

0.042

(0.299)

|

0.132

(0.021)

|

|

0.853

(0.000)

|

-306.173

|

3.071

|

|

STOXX600

|

eGARCH

|

0.058

(0.099)

|

-0.279

(0.000)

|

0.132

(0.201)

|

0.874

(0.000)

|

-329.931

|

3.316

|

|

ATX

|

sGARCH

|

0.354

(0.028)

|

0.438

(0.001)

|

|

0.560

(0.000)

|

-380.268

|

3.804

|

|

DAX

|

sGARCH

|

0.226

(0.145)

|

0.308

(0.000)

|

|

0.690

(0.000)

|

-398.881

|

3.989

|

|

BUX

|

sGARCH

|

0.212

(0.036)

|

0.288

(0.000)

|

|

0.570

(0.000)

|

-377.662

|

4.158

|

|

PX

|

sGARCH

|

0.07188

(0.315)

|

0.160

(0.025)

|

|

0.668

(0.000)

|

-335.377

|

3.321

|

|

WIG20

|

eGARCH

|

0.446

(0.000)

|

-0.368

(0.000)

|

0.546

(0.000)

|

0.822

(0.000)

|

-506.267

|

5.062

|

|

Index

pairs

|

Model

|

α

|

β

|

γ

|

Logl

|

AIC

|

|

CROBEX

– S&P500

|

DCC

|

0.000

(0.998)

|

0.979

(0.000)

|

|

-814.818

|

8.176

|

|

CROBEX

– FTSE100

|

DCC

|

0.004

(0.764)

|

0.983

(0.000)

|

|

-796.573

|

7.995

|

|

CROBEX

– STOXX600

|

aDCC

|

0.033

(0.589)

|

0.497

(0.061)

|

0.140

(0.405)

|

-814.322

|

8.181

|

|

CROBEX

– ATX

|

DCC

|

0.106

(0.046)

|

0.639

(0.000)

|

|

-850.348

|

8.528

|

|

CROBEX

– DAX

|

DCC

|

0.077

(0.089)

|

0.708

(0.000)

|

|

-873.038

|

8.752

|

|

CROBEX – BUX

|

DCC

|

0.075

(0.054)

|

0.608

(0.000)

|

|

-863.490

|

8.433

|

|

CROBEX – PX

|

DCC

|

0.000

(0.887)

|

0.946

(0.000)

|

|

-804.113

|

8.256

|

|

CROBEX – WIG20

|

DCC

|

0.1062

(0.014)

|

0.598

(0.000)

|

|

-976.138

|

9.773

|

|

Index

|

Model

|

ω

|

α

|

γ

|

β

|

δ

|

Logl

|

AIC

|

|

CROBEX

|

sGARCH

|

0.048

(0.000)

|

0.123

(0.000)

|

|

0.848

(0.000)

|

|

-1,023.41

|

2.991

|

|

S&P500

|

sGARCH

|

0.015

(0.022)

|

-0.175

(0.000)

|

0.131

(0.000)

|

0.956

(0.000)

|

|

-1,032.99

|

3.018

|

|

FTSE100

|

sGARCH

|

0.034

(0.020)

|

0.0755

(0.000)

|

|

0.898

(0.000)

|

|

-1,032.99

|

3.018

|

|

STOXX600

|

eGARCH

|

0.046

(0.023)

|

0.114

(0.000)

|

0.174

(0.000)

|

0.857

(0.000)

|

|

-1,081.22

|

3.153

|

|

ATX

|

sGARCH

|

0.026

(0.000)

|

-0.114

(0.000)

|

|

0.972

(0.000)

|

|

-1,286.79

|

3.760

|

|

DAX

|

sGARCH

|

0.041

(0.036)

|

0.097

(0.000)

|

|

0.884

(0.000)

|

|

-1,186.65

|

3.466

|

|

BUX

|

sGARCH

|

0.054

(0.000)

|

0.162

(0.000)

|

|

0.912

(0.000)

|

|

-1,221.45

|

3.412

|

|

PX

|

sGARCH

|

0.042

(0.022)

|

0.096

(0.000)

|

|

0.872

(0.000)

|

|

-1,221.45

|

3.412

|

|

WIG20

|

eGARCH

|

0.041 (0.036)

|

0.097 (0.000)

|

|

0.884 (0.000)

|

|

-1,186.65

|

3.466

|

|

Index

pairs

|

Model

|

α

|

β

|

γ

|

Logl

|

AIC

|

|

CROBEX

– S&P500

|

DCC

|

0.012

(0.381)

|

0.961

(0.000)

|

|

-1,249.83

|

8.160

|

|

CROBEX

– FTSE100

|

DCC

|

0.049

(0.015)

|

0.931

(0.000)

|

|

-1,188.46

|

7.763

|

|

CROBEX

– STOXX600

|

DCC

|

0.048

(0.057)

|

0.938

(0.000)

|

|

-1,237.20

|

8.079

|

|

CROBEX

– ATX

|

DCC

|

0.008

(0.358)

|

0.962

(0.000)

|

|

-1,232.79

|

8.050

|

|

CROBEX

– DAX

|

aDCC

|

0.041

(0.057)

|

0.928

(0.000)

|

0.019

(0.685)

|

-1,313.21

|

8.577

|

|

CROBEX

– BUX

|

DCC

|

0.000

(0.288)

|

0.954

(0.000)

|

|

-1,411.32

|

8.336

|

|

CROBEX

– PX

|

aDCC

|

0.043

(0.000)

|

0.956

(0.000)

|

0.022

(0.225)

|

-1,397.34

|

8.621

|

|

CROBEX

– WIG20

|

DCC

|

0.094

(0.126)

|

0.360

(0.433)

|

|

-1,372.82

|

8.956

|

|

Index

|

Model

|

ω

|

α

|

γ

|

β

|

δ

|

Logl

|

AIC

|

|

CROBEX

|

sGARCH

|

1.269

(0.026)

|

0.221

(0.000)

|

|

0.518

(0.000)

|

|

-857.067

|

4.337

|

|

S&P500

|

eGARCH

|

0.049

(0.075)

|

-0.195

(0.000)

|

0.027

(0.472)

|

0.890

(0.000)

|

|

-647.875

|

3.289

|

|

FTSE100

|

sGARCH

|

0.039

(0.241)

|

0.023

(0.148)

|

|

0.935

(0.000)

|

|

-565.582

|

2.869

|

|

STOXX600

|

sGARCH

|

0.050

(0.138)

|

0.043

(0.025)

|

|

0.912

(0.000)

|

|

-598.827

|

3.036

|

|

ATX

|

gjrGARCH

|

0.026

(0.052)

|

0.048

(0.063)

|

0.057

(0.145)

|

0.895

(0.000)

|

|

-553.632

|

2.814

|

|

DAX

|

sGARCH

|

0.061

(0.116)

|

0.048

(0.007)

|

|

0.919

(0.000)

|

|

-695.427

|

3.523

|

|

BUX

|

sGARCH

|

0.002

(0.052)

|

0.028

(0.000)

|

|

0.955

(0.000)

|

|

-421.736

|

2.145

|

|

PX

|

gjrGARCH

|

0.048

(0.032)

|

0.045

(0.000)

|

-0.047

(0.054)

|

0.962

(0.000)

|

|

-793.558

|

3.892

|

|

WIG20

|

gjrGARCH

|

0.049

(0.048)

|

0.049

(0.001)

|

-0.032

(0.119)

|

0.949

(0.000)

|

|

-787.256

|

3.991

|

|

Index

pairs

|

Model

|

α

|

β

|

γ

|

Logl

|

AIC

|

|

CROBEX

– S&P500

|

DCC

|

0.000

(0.998)

|

0.920

(0.000)

|

|

-1,513.53

|

7.680

|

|

CROBEX

– FTSE100

|

DCC

|

0.012

(0.223)

|

0.965

(0.000)

|

|

-895.32

|

4.565

|

|

CROBEX

– STOXX600

|

DCC

|

0.011

(0.203)

|

0.946

(0.000)

|

|

-1,207.31

|

6.137

|

|

CROBEX

– ATX

|

DCC

|

0.008

(0.778)

|

0.800

(0.000)

|

|

-1,410.83

|

7.173

|

|

CROBEX

– DAX

|

DCC

|

0.000

(0.999)

|

0.870

(0.000)

|

|

-1,549.85

|

7.873

|

|

CROBEX – BUX

|

DCC

|

0.577

(0.000)

|

0.375

(0.000)

|

|

-1,822.21

|

8.923

|

|

CROBEX – PX

|

DCC

|

0.466

(0.000)

|

0.394

(0.000)

|

|

-1,744.37

|

8.647

|

|

CROBEX – WIG20

|

DCC

|

0.451

(0.000)

|

0.477

(0.000)

|

|

-1,632.89

|

8.296

|

|

Index

|

Model

|

ω

|

α

|

γ

|

β

|

δ

|

Logl

|

AIC

|

|

CROBEX

|

sGARCH

|

0.089

(0.002)

|

0.059

(0.000)

|

|

0.899

(0.000)

|

|

-1,236.83

|

3.560

|

|

S&P500

|

eGARCH

|

-0.002

(0.698)

|

-0.070

(0.031)

|

0.078

(0.013)

|

0.951

(0.000)

|

|

-950.66

|

2.742

|

|

FTSE100

|

sGARCH

|

0.078

(0.030)

|

0.100

(0.000)

|

|

0.854

(0.000)

|

|

-1,138.37

|

3.278

|

|

STOXX600

|

sGARCH

|

0.039

(0.034)

|

0.126

(0.000)

|

|

0.857

(0.000)

|

|

-1,178.63

|

3.393

|

|

ATX

|

eGARCH

|

-0.010

(0.000)

|

-0.075

(0.000)

|

0.0148 (0.496)

|

0.973

(0.000)

|

|

-858.56

|

2.478

|

|

DAX

|

eGARCH

|

0.050

(0.074)

|

0.114

(0.000)

|

|

0.876

(0.000)

|

|

-1380.57

|

3.972

|

|

BUX

|

sGARCH

|

0.193

(0.022)

|

0.000

(0.000)

|

|

0.955

(0.000)

|

|

-1,470.98

|

4.028

|

|

PX

|

sGARCH

|

0.166

(0.054)

|

0.067

(0.000)

|

|

0.877

(0.000)

|

|

-1,270.98

|

3.867

|

|

WIG20

|

sGARCH

|

0.151

(0.062)

|

0.0548

(0.003)

|

|

0.896

(0.000)

|

|

-1,380.20

|

3.971

|

|

Index

pairs

|

Model

|

α

|

β

|

γ

|

Logl

|

AIC

|

|

CROBEX

– S&P500

|

DCC

|

0.000

(0.998)

|

0.920

(0.000)

|

|

-1,513.53

|

7.680

|

|

CROBEX

– FTSE100

|

DCC

|

0.012

(0.223)

|

0.965

(0.000)

|

|

-895.32

|

4.565

|

|

CROBEX

– STOXX600

|

DCC

|

0.011

(0.203)

|

0.946

(0.000)

|

|

-1,207.31

|

6.137

|

|

CROBEX

– ATX

|

DCC

|

0.008

(0.778)

|

0.800

(0.000)

|

|

-1,410.83

|

7.173

|

|

CROBEX

– DAX

|

DCC

|

0.000

(0.999)

|

0.870

(0.000)

|

|

-1,549.85

|

7.873

|

|

CROBEX

– BUX

|

DCC

|

0.000

(0.568)

|

0.956

(0.000)

|

|

-1,756.92

|

8.994

|

|

CROBEX

– PX

|

DCC

|

0.572

(0.879)

|

0.534

(0.000)

|

|

-1,589.74

|

8.177

|

|

CROBEX

– WIG20

|

DCC

|

0.451

(0.000)

|

0.477

(0.000)

|

|

-1,632.89

|

8.296

|

|

Index

|

Model

|

ω

|

α

|

γ

|

β

|

δ

|

Logl

|

AIC

|

|

CROBEX

|

sGARCH

|

0.016

(0.135)

|

0.034

(0.013)

|

|

0.952

(0.000)

|

|

-730.117

|

2.978

|

|

S&P500

|

eGARCH

|

0.008

(0.143)

|

0.029

(0.006)

|

|

0.957

(0.000)

|

|

-622.322

|

2.540

|

|

FTSE100

|

sGARCH

|

0.006

(0.089)

|

0.005

(0.668)

|

0.047

(0.017)

|

0.956

(0.000)

|

|

-564.725

|

2.311

|

|

STOXX600

|

sGARCH

|

0.015

(0.021)

|

0.006

(0.734)

|

0.128

(0.002)

|

0.910

(0.000)

|

|

-652.934

|

2.669

|

|

ATX

|

sGARCH

|

0.046

(0.308)

|

0.073

(0.044)

|

|

0.861

(0.000)

|

|

-602.566

|

2.460

|

|

DAX

|

sGARCH

|

0.018

(0.135)

|

0.074

(0.000)

|

|

0.913

(0.000)

|

|

-836.468

|

3.409

|

|

BUX

|

sGARCH

|

0.067

(0.567)

|

0.096

(0.067)

|

|

0.785

(0.000)

|

|

-892.217

|

2.966

|

|

PX

|

sGARCH

|

0.019

(0.478)

|

0.064

(0.000)

|

|

0.978

(0.000)

|

|

-847.155

|

3.522

|

|

WIG20

|

sGARCH

|

0.001

(0.564)

|

0.0478

(0.000)

|

0.035

(0.000)

|

0.996

(0.000)

|

|

-801.450

|

3.271

|

|

Index

pairs

|

Model

|

α

|

β

|

γ

|

Logl

|

AIC

|

|

CROBEX

– S&P500

|

DCC

|

0.019

(0.365)

|

0.917

(0.000)

|

|

-1,347.70

|

5.512

|

|

CROBEX

– FTSE100

|

DCC

|

0.007

(0.426)

|

0.980

(0.000)

|

|

-1,271.10

|

5.209

|

|

CROBEX

– STOXX600

|

DCC

|

0.071

(0.027)

|

0.706

(0.000)

|

|

-1,379.04

|

5.639

|

|

CROBEX

– ATX

|

aDCC

|

0.014

(0.395)

|

0.936

(0.000)

|

0.014

(0.519)

|

-1,327.43

|

5.433

|

|

CROBEX

– DAX

|

DCC

|

0.019

(0.073)

|

0.957

(0.000)

|

|

-1,558.00

|

6.365

|

|

CROBEX – BUX

|

DCC

|

0.027

(0.008)

|

0.997

(0.000)

|

|

-1,733.22

|

6.685

|

|

CROBEX – PX

|

DCC

|

0.020

(0.055)

|

0.978

(0.000)

|

|

-1,655.10

|

6.467

|

|

CROBEX – WIG20

|

DCC

|

0.000

(0.899)

|

0.931

(0.008)

|

|

-1,532.08

|

6.260

|

|

Index

|

Model

|

ω

|

α

|

γ

|

β

|

δ

|

Logl

|

AIC

|

|

CROBEX

|

sGARCH

|

0.272

(0.000)

|

0.274

(0.000)

|

|

0.443

(0.000)

|

|

-848.33

|

2.655

|

|

S&P500

|

eGARCH

|

0.025

(0.022)

|

0.053

(0.000)

|

|

0.894

(0.000)

|

|

-657.45

|

2.060

|

|

FTSE100

|

sGARCH

|

0.015

(0.040)

|

0.063

(0.000)

|

|

0.898

(0.000)

|

|

-579.05

|

1.816

|

|

STOXX600

|

gjrGARCH

|

0.038

(0.000)

|

-0.221

(0.000)

|

0.002

(0.937)

|

0.942

(0.000)

|

|

-662.30

|

2.078

|

|

ATX

|

eGARCH

|

0.006

(0.512)

|

-0.142

(0.000)

|

0.166

(0.000)

|

0.926

(0.000)

|

|

-911.51

|

2.855

|

|

DAX

|

sGARCH

|

0.060

(0.024)

|

0.101

(0.001)

|

|

0.827

(0.000)

|

|

-827.05

|

2.589

|

|

BUX

|

sGARCH

|

0.078

(0.003)

|

0.458

(0.000)

|

|

0.948

(0.000)

|

|

-1,452.66

|

3.532

|

|

PX

|

sGARCH

|

0.071

(0.784)

|

0.526

(0.418)

|

|

0.921

(0.000)

|

|

-1,397.77

|

3.459

|

|

WIG20

|

eGARCH

|

0.009

(0.015)

|

0.025

(0.241)

|

0.116

(0.050)

|

0.989

(0.000)

|

|

-1,091.26

|

3.415

|

|

Index

pairs

|

Model

|

α

|

β

|

γ

|

Logl

|

AIC

|

|

CROBEX

– S&P500

|

DCC

|

0.0176

(0.094)

|

0.966

(0.000)

|

|

-1,503.86

|

4.719

|

|

CROBEX

– FTSE100

|

DCC

|

0.018

(0.151)

|

0.960

(0.000)

|

|

-1,409.02

|

4.430

|

|

CROBEX

– STOXX600

|

DCC

|

0.011

(0.298)

|

0.957

(0.000)

|

|

-1,528.45

|

4.795

|

|

CROBEX

– ATX

|

DCC

|

0.011

(0.359)

|

0.961

(0.000)

|

|

-1,757.78

|

5.510

|

|

CROBEX

– DAX

|

DCC

|

0.003

(0.800)

|

0.964

(0.000)

|

|

-1,652.63

|

5.188

|

|

CROBEX

– BUX

|

DCC

|

0.019

(0.667)

|

0.988

(0.000)

|

|

2,578.33

|

6.366

|

|

CROBEX

– PX

|

DCC

|

0.023

(0.541)

|

0.974

(0.089)

|

|

-2,341.22

|

6.225

|

|

CROBEX

– WIG20

|

DCC

|

0.017

(0.114)

|

0.955

(0.000)

|

|

-1,927.81

|

6.046

|

|

Index

|

Model

|

ω

|

α

|

γ

|

β

|

δ

|

Logl

|

AIC

|

|

CROBEX

|

sGARCH

|

0.188

(0.018)

|

0.222

(0.000)

|

|

0.759

(0.000)

|

|

-838.207

|

4.128

|

|

S&P500

|

eGARCH

|

0.033

(0.000)

|

-0.171

(0.000)

|

0.123

(0.000)

|

0.976

(0.000)

|

|

-831.024

|

4.098

|

|

FTSE100

|

sGARCH

|

0.030

(0.121)

|

0.146

(0.000)

|

|

0.852

(0.000)

|

|

-730.960

|

3.602

|

|

STOXX600

|

eGARCH

|

0.027

(0.007)

|

-0.192

(0.000)

|

0.075

(0.059)

|

0.975

(0.000)

|

|

-798.428

|

3.938

|

|

ATX

|

sGARCH

|

0.144

(0.069)

|

0.149

(0.000)

|

|

0.835

(0.000)

|

|

-911.964

|

4.490

|

|

DAX

|

sGARCH

|

0.072

(0.043)

|

0.153

(0.000)

|

|

0.845

(0.000)

|

|

-814.222

|

4.010

|

|

BUX

|

sGARCH

|

0.187

(0.335)

|

0.189

(0.000)

|

|

0.948

(0.000)

|

|

-817.657

|

4.230

|

|

PX

|

sGARCH

|

0.075

(0.087)

|

0.112

(0.000)

|

|

0.874

(0.000)

|

|

-834.447

|

4.230

|

|

WIG20

|

sGARCH

|

0.085

(0.153)

|

0.0911

(0.001)

|

|

0.896

(0.000)

|

|

-882.125

|

4.343

|

|

Index

pairs

|

Model

|

α

|

β

|

γ

|

Logl

|

AIC

|

|

CROBEX

– S&P500

|

DCC

|

0.026

(0.109)

|

0.928

(0.000)

|

|

-1,659.48

|

8.188

|

|

CROBEX

– FTSE100

|

DCC

|

0.061

(0.003)

|

0.902

(0.000)

|

|

-1,511.40

|

7.462

|

|

CROBEX

– STOXX600

|

DCC

|

0.035

(0.141)

|

0.915

(0.000)

|

|

-1,576.28

|

7.780

|

|

CROBEX

– ATX

|

DCC

|

0.050

(0.095)

|

0.804

(0.000)

|

|

-1,679.81

|

8.288

|

|

CROBEX

– DAX

|

DCC

|

0.074

(0.015)

|

0.819

(0.000)

|

|

-1,575.50

|

7.777

|

|

CROBEX

– BUX

|

DCC

|

0.043

(0.062)

|

0.865

(0.000)

|

|

-1,593.23

|

7.922

|

|

CROBEX

– PX

|

DCC

|

0.049

(0.326)

|

0.905

(0.000)

|

|

-1,578.13

|

8.102

|

|

CROBEX

– WIG20

|

DCC

|

0.002

(0.749)

|

0.979

(0.000)

|

|

-1,664.30

|

8.212

|

|

Index

|

Model

|

ω

|

α

|

γ

|

β

|

δ

|

Logl

|

AIC

|

|

CROBEX

|

sGARCH

|

0.048

(0.000)

|

0.123

(0.000)

|

|

0.848

(0.000)

|

|

-1,023.41

|

2.991

|

|

S&P500

|

eGARCH

|

0.015

(0.022)

|

-0.175

(0.000)

|

0.131

(0.000)

|

0.956

(0.000)

|

|

-1,054.26

|

3.083

|

|

FTSE100

|

sGARCH

|

0.034

(0.020)

|

0.075

(0.000)

|

|

0.898

(0.000)

|

|

-1,032.99

|

3.018

|

|

STOXX600

|

sGARCH

|

0.046

(0.023)

|

0.114

(0.000)

|

|

0.857

(0.000)

|

|

-1,081.22

|

3.159

|

|

ATX

|

eGARCH

|

0.026

(0.000)

|

-0.114

(0.000)

|

0.174

(0.000)

|

0.972

(0.000)

|

|

-1,286.79

|

3.760

|

|

DAX

|

sGARCH

|

0.041

(0.036)

|

0.097

(0.000)

|

|

0.884

(0.000)

|

|

-1,186.65

|

3.466

|

|

BUX

|

sGARCH

|

0.054

(0.042)

|

0.086

(0.000)

|

|

0.962

(0.000)

|

|

-1,011.23

|

2.885

|

|

PX

|

sGARCH

|

0.039

(0.064)

|

0.092

(0.000)

|

|

0.894

(0.000)

|

|

-1,039.84

|

2.999

|

|

WIG20

|

sGARCH

|

0.041

(0.036)

|

0.097

(0.000)

|

|

0.884

(0.000)

|

|

-1,186.65

|

3.466

|

|

Index

pairs

|

Model

|

α

|

β

|

γ

|

Logl

|

AIC

|

|

CROBEX

– S&P500

|

DCC

|

0.000

(0.999)

|

0.914

(0.000)

|

|

-2,066.35

|

6.047

|

|

CROBEX

– FTSE100

|

DCC

|

0.036

(0.158)

|

0.785

(0.000)

|

|

-2,003.32

|

5.864

|

|

CROBEX

– STOXX600

|

DCC

|

0.037

(0.140)

|

0.855

(0.000)

|

|

-2,042.42

|

5.977

|

|

CROBEX

– ATX

|

aDCC

|

0.051

(0.009)

|

0.908

(0.000)

|

0.014

(0.700)

|

-2,252.50

|

6.592

|

|

CROBEX

– DAX

|

aDCC

|

0.036

(0.524)

|

0.729

(0.000)

|

0.055

(0.644)

|

-2,158.95

|

6.320

|

|

CROBEX

– BUX

|

DCC

|

0.026

(0.189)

|

0.966

(0.000)

|

|

-2,047.59

|

6.00

|

|

CROBEX

– PX

|

DCC

|

0.037

(0.136)

|

0.845

(0.000)

|

|

-2,018.22

|

5.912

|

|

CROBEX

– WIG20

|

DCC

|

0.000

(0.999)

|

0.914

(0.000)

|

|

-2,185.96

|

6.401

|

|

Index

|

Model

|

ω

|

α

|

γ

|

β

|

δ

|

Logl

|

AIC

|

|

CROBEX

|

sGARCH

|

0.017

(0.038)

|

0.058

(0.002)

|

|

0.909

(0.000)

|

|

-577.732

|

2.331

|

|

S&P500

|

sGARCH

|

0.045

(0.008)

|

0.137

(0.000)

|

|

0.824

(0.000)

|

|

-696.614

|

2.808

|

|

FTSE100

|

eGARCH

|

-0.001

(0.766)

|

-0.138

(0.000)

|

0.065

(0.078)

|

0.981

(0.000)

|

|

-662.568

|

2.675

|

|

STOXX600

|

eGARCH

|

0.002

(0.610)

|

-0.160

(0.000)

|

0.041

(0.000)

|

0.980

(0.000)

|

|

-726.550

|

2.932

|

|

ATX

|

sGARCH

|

0.019

(0.112)

|

0.047

(0.001)

|

|

0.943

(0.000)

|

|

-916.754

|

3.690

|

|

DAX

|

sGARCH

|

0.031

(0.081)

|

0.072

(0.001)

|

|

0.913

(0.000)

|

|

-867.097

|

3.491

|

|

BUX

|

sGARCH

|

0.006

(0.459)

|

0.084

(0.000)

|

|

0.921

(0.000)

|

|

-798.514

|

3.124

|

|

PX

|

sGARCH

|

0.031

(0.985)

|

0.051

(0.000)

|

|

0.962

(0.000)

|

|

-801.044

|

3.266

|

|

WIG20

|

sGARCH

|

0.018

(0.096)

|

0.066

(0.000)

|

|

0.924

(0.000)

|

|

-807.977

|

3.254

|

|

Index

pairs

|

Model

|

α

|

β

|

γ

|

Logl

|

AIC

|

|

CROBEX

– S&P500

|

DCC

|

0.064

(0.244)

|

0.758

(0.003)

|

|

-2,185.96

|

6.401

|

|

CROBEX

– FTSE100

|

DCC

|

0.012

(0.068)

|

0.982

(0.000)

|

|

-1,233.24

|

4.986

|

|

CROBEX

– STOXX600

|

DCC

|

0.010

(0.122)

|

0.985

(0.000)

|

|

-1,298.36

|

5.248

|

|

CROBEX

– ATX

|

DCC

|

0.017

(0.090)

|

0.978

(0.000)

|

|

-1,456.72

|

5.882

|

|

CROBEX

– DAX

|

DCC

|

0.011

(0.057)

|

0.984

(0.000)

|

|

-1,416.62

|

5.721

|

|

CROBEX – BUX

|

DCC

|

0.052

(0.325)

|

0.956

(0.000)

|

|

-1,385.76

|

5.244

|

|

CROBEX – PX

|

DCC

|

0.012

(0.074)

|

0.896

(0.000)

|

|

-1,399.21

|

5.635

|

|

CROBEX

– WIG20

|

aDCC

|

0.015

(0.055)

|

0.979

(0.000)

|

0.001

(0.921)

|

-1,365.01

|

5.519

|

|

Index

|

Model

|

ω

|

α

|

γ

|

β

|

δ

|

Logl

|

AIC

|

|

CROBEX

|

sGARCH

|

0.013

(0.741)

|

0.037

(0.477)

|

|

0.907

(0.000)

|

|

-422.023

|

1.429

|

|

S&P500

|

sGARCH

|

0.058

(0.002)

|

0.199

(0.000)

|

|

0.727

(0.000)

|

|

-653.439

|

2.209

|

|

FTSE100

|

eGARCH

|

-0.030

(0.039)

|

-0.223

(0.000)

|

0.123

(0.007)

|

0.952

(0.000)

|

|

-619.138

|

2.094

|

|

STOXX600

|

sGARCH

|

0.028

(0.039)

|

0.123

(0.000)

|

|

0.857

(0.000)

|

|

-814.607

|

2.747

|

|

ATX

|

sGARCH

|

0.309

(0.029)

|

0.116

(0.004)

|

|

0.648

(0.000)

|

|

-917.427

|

3.092

|

|

DAX

|

sGARCH

|

0.031

(0.045)

|

0.102

(0.000)

|

|

0.883

(0.000)

|

|

-938.051

|

3.161

|

|

BUX

|

sGARCH

|

0.034

(0.084)

|

0.355

(0.000)

|

|

0.978

(0.000)

|

|

-924.025

|

3.332

|

|

PX

|

sGARCH

|

0.048

(0.123)

|

0.024

(0.120)

|

|

0.877

(0.000)

|

|

-889.051

|

3.665

|

|

WIG20

|

eGARCH

|

0.006

(0.235)

|

-0.078

(0.001)

|

0.089

(0.084)

|

0.973

(0.000)

|

|

-862.443

|

2. 613

|

|

Index

pairs

|

Model

|

α

|

β

|

γ

|

Logl

|

AIC

|

|

CROBEX

– S&P500

|

DCC

|

0.000

(0.997)

|

0.887

(0.000)

|

|

-1,067.06

|

3.624

|

|

CROBEX

– FTSE100

|

DCC

|

0.045

(0.333)

|

0.481

(0.010)

|

|

-1,030.41

|

3.501

|

|

CROBEX

– STOXX600

|

DCC

|

0.037

(0.357)

|

0.797

(0.012)

|

|

-1,222.20

|

4.138

|

|

CROBEX

– ATX

|

DCC

|

0.027

(0.220)

|

0.836

(0.000)

|

|

-1,330.35

|

4.501

|

|

CROBEX

– DAX

|

DCC

|

0.027

(0.140)

|

0.906

(0.000)

|

|

-1,345.52

|

4.554

|

|

CROBEX – BUX

|

DCC

|

0.035

(0.566)

|

0.795

(0.000)

|

|

-1,328.64

|

4.347

|

|

CROBEX – PX

|

DCC

|

0.000

(0.412)

|

0.741

(0.000)

|

|

-1,202.54

|

4.255

|

|

CROBEX – WIG20

|

DCC

|

0.000

(0.998)

|

0.905

(0.000)

|

|

-1,280.62

|

4.334

|

|

|

|

Abstract

We investigate stock market co-movements among the Croatian and several other markets (in the US, UK, Germany, Austria, Poland, Czech Republic and Hungary) in the period from 3 September 1997 to 19 August 2016 with dynamic correlation coefficient models. This allows us to analyse long-term trends of the international financial integration of the Zagreb Stock Exchange in the last two decades as well as the separate impacts of major events that influenced financial markets during that period. Our results imply a relatively low level of international financial integration of the Croatian stock market, but some convergence in co-movement with the analysed markets over time is present. The strongest market co-movement is related to the subprime mortgage crisis, and EU accession seems to have made Croatian international integration less segmented.

Keywords: stock market co-movement, Croatian international financial integration, dynamic correlation coefficient models

JEL: G10, G15, N24

1 Introduction

The emerging European stock markets have brief histories compared to more mature markets. Most emerging European countries actively follow economic policies that lead towards more internationally integrated financial markets, yet full integration of these countries’ financial markets is far from complete. Since their initial trading sessions in the first half of the 1990s, the emerging European stock markets have had varied performances in terms of international integration. Horvat and Petrovski (  2013 2013) find that Central European stock markets are highly integrated into the global financial system, whereas those of South-Eastern Europe exhibit a much lower degree of integration. Due to the special characteristics of the Croatian transition process relative to other emerging EU countries (i.e. war destruction in the initial transition phase, delayed EU accession), its financial integration needs to be investigated individually.

In this paper, we examine the co-movement of the Croatian stock market with various European and global financial markets. We are interested in the long-term perspective of financial integration but investigate the impact of several major financial events in last two decades on the integration process as well. There has been some research on stock market integration and closely related topics for emerging European countries (Cappiello et al.,  2006a 2006a; Egert and Kocenda,  2007 2007; Horvat and Petrovski,  2013 2013; Ivanov,  2014 2014), but a detailed examination of the Croatian stock market is lacking. Therefore, we collect daily data on the closing prices of stock market indices from the Zagreb Stock Exchange and several European (UK – FTSE100, broad EU – STOXX600, German – DAX, Austrian – ATX, Polish – WIG20, Czech – PX and Hungarian – BUX) and global (US – S&P500) markets for the period of 3 September 1997 to 19 August 2016. We identified several important events from the literature on the stock market integration of emerging European countries: the Russian crisis (see Jochum et al.,  1999 1999; Gelos and Sahay,  2000 2000), the dot-com crisis and the 9/11 shocks, the subprime mortgage crisis (see Gijka and Horvath,  2012 2012), and EU accession (see Cappiello et al.,  2016b 2016b). Next to these events, we analyse the full sample period as well.

The first significant financial shocks for emerging European markets were the Asian and Russian crisis but since it is hard to separate effects of these two events due to their chronological closeness, we investigate the Russian crisis only. The dot-com crisis was the following event that had a pronounced impact on the global financial system but we include the 9/11 shock in our analysis as well since it represents an important non-financial event that affected financial markets globally in that period. The next important event was the subprime mortgage crisis. It started in United States and propagated to the rest of the world through the financial system, in which emerging European countries were particularly affected. This makes it especially interesting as an event that affected the Croatian financial market as well. Finally, as well as a wider set of economic, social and political effects, EU accession implies the intensification of financial integration between Croatian and European markets. Therefore, it is important to analyse how EU accession affected co-movements among Croatian and other markets.

The analysis of Croatian international stock market integration is of interest to investors looking for diversification opportunities in emerging European countries. Investors who seek financing on the local capital market will be better informed about assessing risk related to the channels of financial shock propagation. The emerging European countries experienced a larger drop in economic activity in the recent financial crisis than other regions (Berglof et al.,  2009 2009), so the implications of this study have relevance for domestic macroeconomic and monetary policy. Melitz and Zumer (  1999 1999) and Baele et al. (  2004 2004) claim that integrated European capital markets may decrease risk and allow for better diversification, while Kassim (  2010 2010) states that the extent of integration is highly relevant in the context of countries aiming for macroeconomic harmonization. Therefore, the financial stability of emerging European markets is important for the stability of the whole region and also has implications for the economic stability of the EU.

We contribute to the existing literature in several ways. Firstly, we use data on the longest time span available and are therefore able to investigate the full history of Croatian stock market co-movements. This allows us to go into detail about different events during that period and put them in a comparative perspective. This is especially interesting with respect to Croatia’s EU accession, which was later than that of other new member states and should be analysed as a separate event. Secondly, our methodological approach makes use of both the dynamic conditional correlation model (DCC) of Engle and Sheppard (  2001 2001) and the asymmetric dynamic conditional correlation model (ADCC) of Cappiello et al. (  2006a 2006a). It is reasonable to assume that correlations between Croatian and other stock markets are time-varying, these models accordingly being able to account for changing dynamics of the correlation structure and suitable for analysing different financial crises and events. Furthermore, by using both, symmetric and asymmetric volatility models we are able to check the impact of positive and negative news (shocks) on volatility. Thirdly, we analyse the co-movements between Croatian and different European and global markets, which allows us to inspect whether different financial incidents and other analysed events drive the correlation structure of these markets. Since similarities in the correlation of returns between different markets imply their closer integration we are also able to make some general conclusions about the structure of financial integration and transmission of global and regional financial shocks.

Our results suggest that the overall level of Croatian international financial integration is relatively low, average correlation in the full period amounting to around 0.25, compared to developed markets. However, there are some tendencies of cross-market correlations to converge over time, which reduces Croatian international market segmentation. The analysis also shows that the subprime crisis had the strongest effect on international market integration, whereas Croatia’s EU accession caused correlation coefficients to converge and somewhat reduced international market segmentation.

The article is organized as follows: section 2 gives an overview of related literature, while section 3 describes the data set and describes the empirical model. Section 4 presents the results and discusses implications. Concluding remarks are given in section 5.

2 Related literature

One of the main interests of the literature about short and long term relationships between stock markets in emerging European countries has been in implications of results for portfolio diversification opportunities. The findings of the literature have been somewhat mixed but mostly point to regional stock market interdependence and imply that there are only limited diversification opportunities for investors in emerging European countries. The results show that there is a longrun relationship among emerging EU stock markets, but much less evidence has been found on the relationship between them and world markets. This is supported in MacDonald ( 2001) and Voronkova ( 2001) and Voronkova ( 2004), which do not find any significant benefits of portfolio diversification when investing in emerging EU stock markets due to their high degree of integration. Their results confirm that co-movement among emerging European markets is much stronger than the relationship between these markets and other world markets. Egert and Kocenda ( 2004), which do not find any significant benefits of portfolio diversification when investing in emerging EU stock markets due to their high degree of integration. Their results confirm that co-movement among emerging European markets is much stronger than the relationship between these markets and other world markets. Egert and Kocenda ( 2007 find some evidence in favour of stock market co-movement among the Czech Republic, Hungary, Poland, and developed European stock markets, but they conclude that portfolio diversification in these markets can still have some advantages. 2007 find some evidence in favour of stock market co-movement among the Czech Republic, Hungary, Poland, and developed European stock markets, but they conclude that portfolio diversification in these markets can still have some advantages.

Several papers analysed how various financial incidents and important events affected the integration of emerging European countries. The results show that different events affect these markets differently and more generally, that there is significant amount of heterogeneity within the sample. Syriopoulos (  2004 2004) investigates the impact of the European Monetary Union on international stock market and the United States. The author finds a co-integrating relationship between every analysed country pair and therefore confirms the long-term relationship among those markets. Cappiello et al. (  2006b 2006b) find that the 2004 EU enlargement increased the international stock market integrations of the new EU members with each other and with EU countries in the period before EU accession. They find that the three largest new EU member states (the Czech Republic, Hungary, and Poland) are much more integrated with each other and with the EU than the smaller countries (Cyprus, Estonia, Latvia, and Slovenia), which do not co-move with each other.

Wang and Moore (  2008 2008) use a dynamic conditional correlation model to study the interdependence of the Czech, Hungarian, Polish and other EU markets. The authors find that the EU accession and the subprime crisis increased the degree of integration of new EU members and other European markets. Kenourgios et al. (  2009 2009) extends the dynamic conditional correlation model with structural breaks to analyse how several financial incidents affected stock market co-movements between developed EU countries, emerging EU countries, and Balkan countries. They find that the dot-com crisis, Euro introduction, and EU enlargement, as well, increased interdependence in these markets.

The literature has been focused on differently defined groups of emerging European countries, which makes it hard to draw clear conclusions about the financial integration of the whole group. Overall, results show that these countries are differently integrated into European and global financial markets. Furthermore, new member states are characterized by a higher degree of financial integration whereas South-Eastern European countries have a somewhat lower degree of financial integration into global and European financial systems. Syriopulos and Roumps (  2005 2005) analyse the integration of Balkan countries’ stock markets with the German and US markets. The results show that developed markets affect Balkan markets in the long term and that correlations among them are dynamic and asymmetric. Egert and Kocenda (  2011 2011) analyse the Czech, Hungarian, and Polish stock markets’ correlation with developed EU countries by using intraday trading data. They find very weak correlations among all the analysed countries, from which they conclude that financial shocks in developed markets have a delayed effect on the emerging EU stock markets. Furthermore, the EU accession effect is found to increase the integration of the analysed markets into world financial markets. Gjika and Horvath (  2012 2012) study stock market co-movements among the Czech Republic, Hungary, and Poland. Their results show that the correlation among the analysed stock markets rose steadily from 2001 onwards. EU accession and the subprime crisis positively affected their integration process. The authors find that correlations between stock market returns are characterized by asymmetric conditional variances and correlations.

In a recent study of the financial integration of South and East European countries with western European markets, Horvat and Petrovski (  2013 2013) find that the stock market integration of Central Europe vis-à-vis Western Europe is much higher than the integration of South-Eastern Europe vis-à-vis Western Europe. Their results show that Croatia has a positive integration trend and higher degree of financial integration than other South-Eastern European countries due to growing economic integration with the EU. Ivanov (  2014 2014) examines the return and volatility spill-overs and stock market co-movements among Western, Central and Southeast European stock markets. The results confirm a high and stable conditional correlation between Central and Western European markets. The conditional correlation between the Croatian market and developed markets is found to be modest but increasing.

Overall, the literature on the stock market integration of emerging European countries is characterized by several heterogeneities, and results have been somewhat mixed. The methodological approach differs among papers which makes it hard to compare the results directly. The literature has focused on different samples of countries, so that drawing implications about the financial integration of the whole region is not straightforward. However, the results confirm a significant mutual financial interdependence among emerging European countries but a somewhat lower degree of their integration into global financial system. The financial integration is generally higher for new member states and central European countries than for Balkan and South European countries. Finally, the results imply that different events and financial incidents have different impacts on this region but usually lead to more integration.

3 Data and model selection

We collected data on closing prices for CROBEX and several other stock markets market indices: S&P500, STOXX600, FTSE100, DAX, ATX, WIG20, PX, and BUX. The data are daily and span the period from 3 September 1997 to 19 August 2016 for all indices. The prices are in HRK for the CROBEX index, US$ for S&P500, PLN for WIG20 and EUR for all other indices. The data were collected from Reuters DataStream service. We calculated the return series as:

| Ri,t = ln(Ii,t) – ln(Ii,t –1) |

where Ii,t is the index price of the i-th country at time t, Ii,t –1 is the index price of the same country in the previous period, and Ri,t is the corresponding rate of return of the index.

Figure 1 shows the return series of all the analysed stock market indices. It can be seen that all series exhibit clustering volatility. Periods of high volatility returns are common to all indices, especially during the recent financial economic crisis, when historically high extreme return values were observed. It can also be seen that the return series of the CROBEX index follows a relatively smooth pattern with few volatility clusters except during the recent economic crisis period.

Figure 1Return plots of the series DISPLAY Figure

Table 1 provides descriptive statistics for all of the return series. The highest and lowest extreme values are observed for the ZSE, WIG20, BUX and PX indexes. Furthermore, the standard deviation shows that the returns of the FTSE100 and S&P500 are the least volatile. Excess kurtosis is reported for all return series and implies non-normality of distribution. Non-normality is also confirmed via rejection of the Jarque-Berra test null-hypothesis. The ARCH effects were found by means of ARCH (10) tests. We applied the augmented DickeyFuller (ADF) to check the presence of unit roots in the return data. As table 1 reveals, all indeks return series are found to be stationary since ADF rejects the null of a unit root at the 1% level.

Table 1Descriptive statistics of return series DISPLAY Table

3.1 Model selection

The asymmetric volatility in the covariance of different assets emerges due to differential volatility reaction to negative and positive shocks of the same magnitude. Furthermore, the existence of declining correlations between stock markets during the rising trends, rising correlations during the negative trends and generally higher correlations during the volatile periods imply that correlations between stock markets are dynamic and time dependent. Therefore, these correlations should be measured with proper dynamic correlation models that are able to account for time variation in the correlation structure. Here we find the dynamic conditional correlation model of Engle and Sheppard (  2001 2001) and the asymmetric dynamic conditional correlation model of Cappiello et al. (  2006a 2006a) particularly suitable.

Our methodological procedure consists of two steps. In the first part we find the best-fitted GARCH model among several possibilities: Bollerslev’s (  1986 1986) GARCH model, the exponential GARCH model of Nelson (  1991 1991), and the GJR-GARCH model of Glosten et al. (  1993 1993). In the second part we feed the residuals from the first step into the DCC model and the ADCC model to choose the best fitted model between the two.

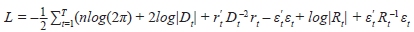

The residuals from the best fit GARCH model in the first stage are fed into the dynamic conditional correlation model of Engle and Sheppard (  2001 2001) and the asymmetric dynamic conditional correlation model of Cappiello et al. (  2006a 2006a) in the second stage of the estimation. We then selected the best model between the two via AIC criteria. The dynamic conditional correlation model is defined as:

| rt | It –1 ~ N (0, Ht) |

(1) |

where rt is the return series, assumed to be normally distributed with a mean of zero, and It –1 is the information set available in the previous period. Ht is a conditional covariance matrix assumed to be positive definite:

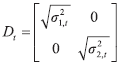

where Dt is a diagonal matrix of time-dependent volatilities from univariate GARCH models obtained in the first step that takes the shape:

|  | | |

|

(3) |

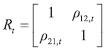

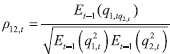

R t is a time-varying correlation matrix of standardized residuals εt = Dt-1 rt ~ N (0, Rt) that takes the shape

|  | |

|

(4) |

where  is the conditional correlation estimation between two returns. The elements of Rt are obtained by using a series of standardized residuals as Rt = Qt* – 0.5 Qt Qt* – 0.5 where:

| Qt = (1 – α – β)Q¯ + α εt–1 ε' t–1 + βQt–1 |

(5) |